More Stamp Duty changes in Autumn Statement

Chancellor Jeremy Hunt’s Autumn Statement on 17 November left housing out of the limelight, though it did include a commitment to keep the Stamp Duty Land Tax (SDLT) changes announced in the ‘mini-budget’ – for now.

In September, then-Chancellor Kwasi Kwarteng increased the nil-rate threshold of SDLT to £250,000 (previously £125,000) for residential property in England and Northern Ireland. First-time buyers (FTBs), it was announced, could spend £425,000 (previously £300,000) without paying a penny in tax.

Moreover, FTBs also benefited from an increased maximum purchase price of £625,000 for which First Time Buyers’ Relief could be claimed, up from £500,000.

In his Autumn Statement, Mr Hunt confirmed that he will uphold these changes – but only until March 2025. Originally, the changes had been implemented on a permanent basis.

Elsewhere in the Autumn Statement, rent increases in the social housing sector will be capped at 7% in the next financial year. In total, Mr Hunt announced around £55bn in spending cuts and tax rises.

Hesitant FTBs put the brakes on

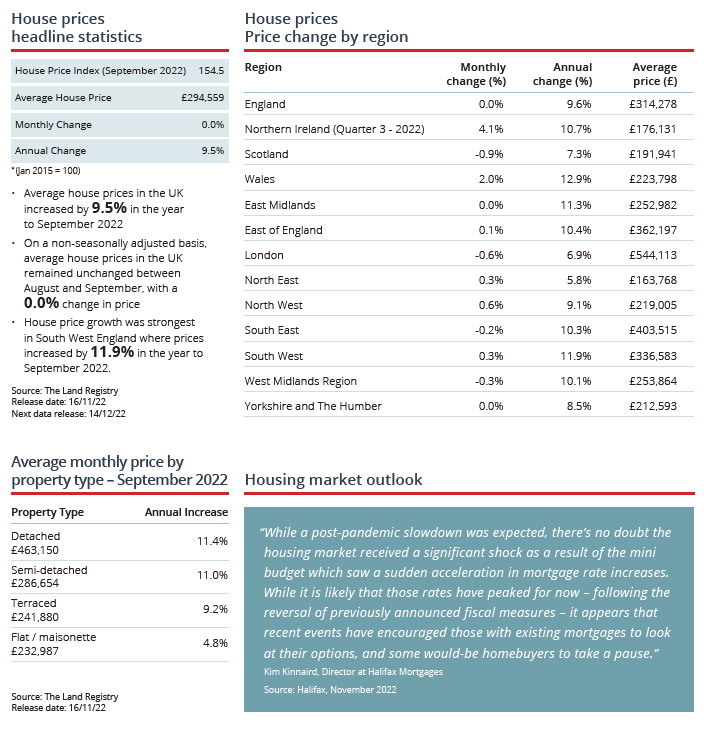

Higher mortgage costs have caused many prospective buyers to put the brakes on their house purchase, with those buying their first home the worst impacted.

Buyer demand fell by 20% in October compared to a year earlier, according to Rightmove, with soaring borrowing costs and rising economic uncertainty the key drivers. FTBs were the most hesitant, with demand down 26% in the month.

FTBs have lost another motivation to buy since the end of the Help to Buy Equity Loan scheme. The scheme, which was set up to help FTBs purchase a home in England, has now closed to new applications; all homes purchased via the scheme will need to have completed by the end of March 2023.

Help remains for FTBs, however, including the Lifetime ISA, which adds a government bonus of 25% onto savings up to £4,000 each year. The Help to Buy ISA, meanwhile, has closed for new applicants, though anyone with an existing account can still add up to £200 per month until November 2029.

A quarter of landlords plan to sell

More than one in four landlords is thinking about selling properties, according to a new survey that reveals the extent of discontent in the sector.

In recent years, landlords have had to deal with a variety of regulatory and tax changes, as well as stricter Energy Performance Certificate (EPC) requirements.In response, 39% of buy-to-let investors now plan to put rents up.

Donna Hopton, Director at cherry, which carried out the research, noted that, during recent market turbulence, buy-to-let investors have “arguably been hit hardest”. Despite this, she said, “there are also millions of landlords who remain committed to the market, and it’s a market of continued demand from tenants and rising rents, so there will be plenty of opportunity for property investors.”

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.