Savills’ most recent review of the UK commercial property ‘Market in Minutes‘, includes analysis on the connection between sustainability and growth in the sector. With sustainability issues generally rising to the fore, the property sector is no exception, as developers tune into this growing area of interest.

Occupiers are increasingly indicating that they are prepared to only pay a rental premium for buildings with notable environmental certifications, such as BREEAM (Building Research Establishment Environmental Assessment Method). This is an international scheme providing independent third-party certification of the assessment of the sustainability performance of individual buildings, communities and infrastructure projects.

The benefits of more sustainable buildings are wide ranging. In addition to potentially generating lower long-term operational costs, they can also draw higher occupancy rates and command higher rents. They also tend to experience quicker lease-up times and drive an increase in capital value.

The research provides examples where a high BREEAM rating is commanding higher rents, such as in Manchester’s business district. Landmark, a Grade A scheme, offering sustainable features such as electric car charging points and solar panels, has a BREEAM rating of ‘Excellent’ and is let at the city’s premium rental rate of £36.50 per sq ft.

With footfall numbers plummeting by over two fifths last year, after the pandemic and lockdowns took their toll, retailers have vocalised their requirement for further government support.

According to data from the British Retail Consortium, UK footfall halved in Q4. London was hardest hit in December, with footfall down 58%, as it was among the first areas to enter tier 4 restrictions, involving closure of most high street stores, restaurants and pubs. Other badly impacted areas were South East England and Wales.

Helen Dickinson, Chief Executive of the British Retail Consortium, called on the government to extend a property tax holiday for retailers in the face of Lockdown 3.0, commenting, “A third lockdown will be one too many for some businesses. Rent bills continue to weigh heavily and the threat of a return to full business rates liability in April still looms. The government must urgently reassure those businesses hardest hit by the pandemic that they will receive vital financial support in the form of an extension to the coronavirus business rates relief.”

Global commercial property broker and manager, CBRE, recently released a snapshot of the UK logistics sector, reporting that 2020 was a record year. Following two record quarters (Q2 and Q3 2020), a ‘huge jump in investment’ in Q4 was evident, demonstrating the continued popularity of the logistics sector. Total investment for the year was £8bn, with a colossal £4.6bn recorded in Q4 alone.

The most active logistics sectors in 2020 were online retail (31.3%) and third-party logistics (29.3%), which involves an organisation’s use of third-party businesses to outsource elements of its distribution, warehousing, and fulfilment services. Unable to keep up with the unprecedented demand, a significant decrease in vacancy and availability was recorded. According to CBRE, the outlook for the year ahead looks ‘promising’, with an increase in properties under offer already occurring.

Source: Zoopla, data extracted 21 January 2021

| Region | No. properties | AVG. asking price |

|---|---|---|

| London | 1,262 | £1,235,606 |

| South East England | 1,221 | £642,608 |

| East Midlands | 836 | £964,710 |

| East of England | 749 | £539,865 |

| North East England | 913 | £331,128 |

| North West England | 1,619 | £424,906 |

| South West England | 1,659 | £629,553 |

| West Midlands | 1,171 | £499,117 |

| Yorkshire and The Humber | 1,292 | £315,601 |

| Isle of Man | 50 | £463,587 |

| Scotland | 1,295 | £291,502 |

| Wales | 737 | £383,420 |

| Northern Ireland | 34 | £294,522 |

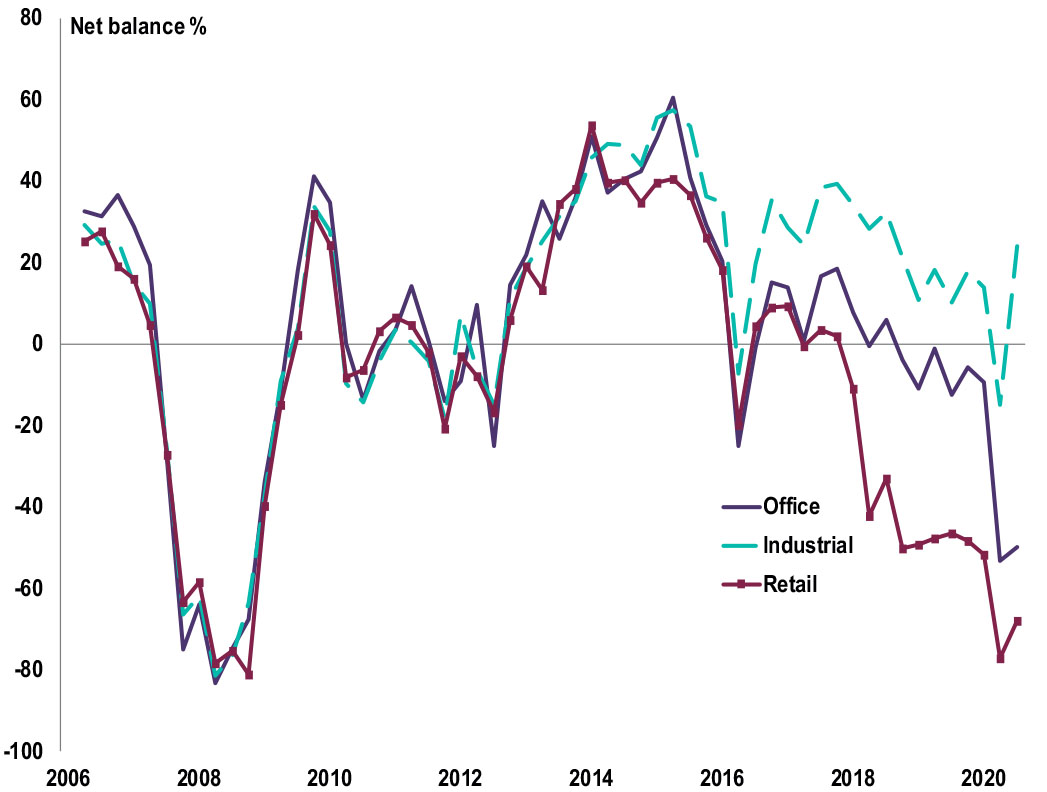

Source: RICS, UK Commercial Property Market Survey, Q3 2020

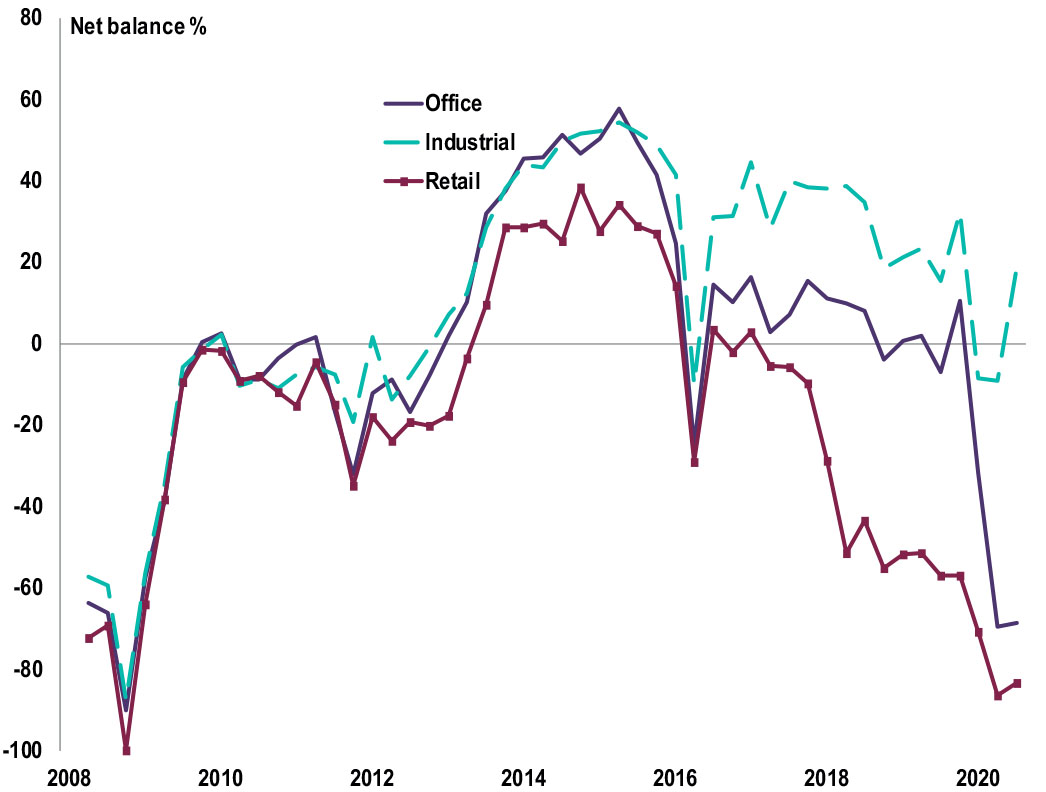

Source: RICS, UK Commercial Property Market Survey, Q3 2020

All details are correct at the time of writing (21 January 2021)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.