By the end of 2020, according to Savills, take-up of industrial warehouse units is on course to exceed 50 million sq ft, far exceeding the previous record of 37 million sq ft, set in 2018. Rounding off a record year for the sector, this growth can be partly attributed to the astronomical rise in online shopping.

Data indicates that online retail accounted for 37% of the 46.8 million sq ft take-up recorded so far, 29.6% of which has been taken by Amazon. Interestingly though, there has been a real mix of sector occupiers. In addition to online retail distribution, demand has increased from third party logistics firms and alternative sectors such as data centres and film studios. The increased requirement for IT capability, with more people working from home, as well as the popularity of streaming services like Amazon Prime and Netflix, have prompted this.

Consequently, Grade A supply is at its lowest level in four years, with the national vacancy rate averaging 6.01%. Over 8.5 million sq ft of warehouse space is currently under construction for delivery next year.

National Head of Industrial & Logistics at Savills, Richard Sullivan commented, “This year has proven just how critical industrial & logistics is to keeping the UK moving. Whilst online retail continues to dominate, it is important to recognise the breadth of occupiers that make up the market. With new sectors emerging and existing ones constantly evolving, we must ensure we have the right size space in the right locations to cater to this demand and it is encouraging to see speculative announcements pick back up in line with growing confidence.”

In December, Arcadia Group went into administration, putting 13,000 jobs at risk at retailers such as Topshop and Dorothy Perkins, signalling a further blow to the ailing retail sector. Arcadia has 444 leased stores in the UK and 22 overseas. Its numerous landlords include listed property companies such as Hammerson, Landsec and British Land. Administrators are seeking expressions of interest from potential buyers.

As a plethora of retail businesses have struggled with the pandemic, impacting their ability to pay rent, a raft of retail property owners have taken a hit to their rental incomes this year. Chief Executive of trade association British Property Federation, Melanie Leech commented, “Retailers are grappling with challenges today that pre-date this pandemic but COVID-19 is bringing into sharper focus which businesses have invested, innovated and adapted to changing consumer behaviours. Those that have not, have very little resilience in the face of economic headwinds and it is their staff and their creditors including property owners, and the millions of pensioners and savers they represent, who are paying for their failure.”

Debenhams is also set to close its stores by the end of March 2021, threatening 12,000 jobs, after administrators failed to find a buyer for the business. Mike Ashley’s Frasers Group has confirmed it is working on a possible rescue deal to secure the store.

According to Colliers International’s Q3 Scotland snapshot, commercial property investment rebounded in the third quarter, to reach £477m, the highest quarterly figure this year, following a slow Q2, with just £35m in investment recorded.

While the Q3 figure is still nearly 20% below the five-year quarterly average of £564m, Colliers believe there is hope for a strong end to the year with pent-up demand driving activity. By value, the office and alternative sectors accounted for three quarters of activity, and industrial sector investment volumes are 40% above the five-year quarterly average. Renewed interest from Asia-Pacific investors has accounted for over half of all investment volumes.

Source: Zoopla, data extracted 15 December 2020

| Region | No. properties | AVG. asking price |

|---|---|---|

| London | 1,314 | £1,194,088 |

| South East England | 1,288 | £643,705 |

| East Midlands | 876 | £960,312 |

| East of England | 730 | £520,401 |

| North East England | 958 | £306,816 |

| North West England | 1,706 | £415,854 |

| South West England | 1,764 | £621,123 |

| West Midlands | 1,187 | £629,857 |

| Yorkshire and The Humber | 1,292 | £308,792 |

| Isle of Man | 52 | £478,449 |

| Scotland | 1,339 | £296,045 |

| Wales | 780 | £391,778 |

| Northern Ireland | 27 | £283,547 |

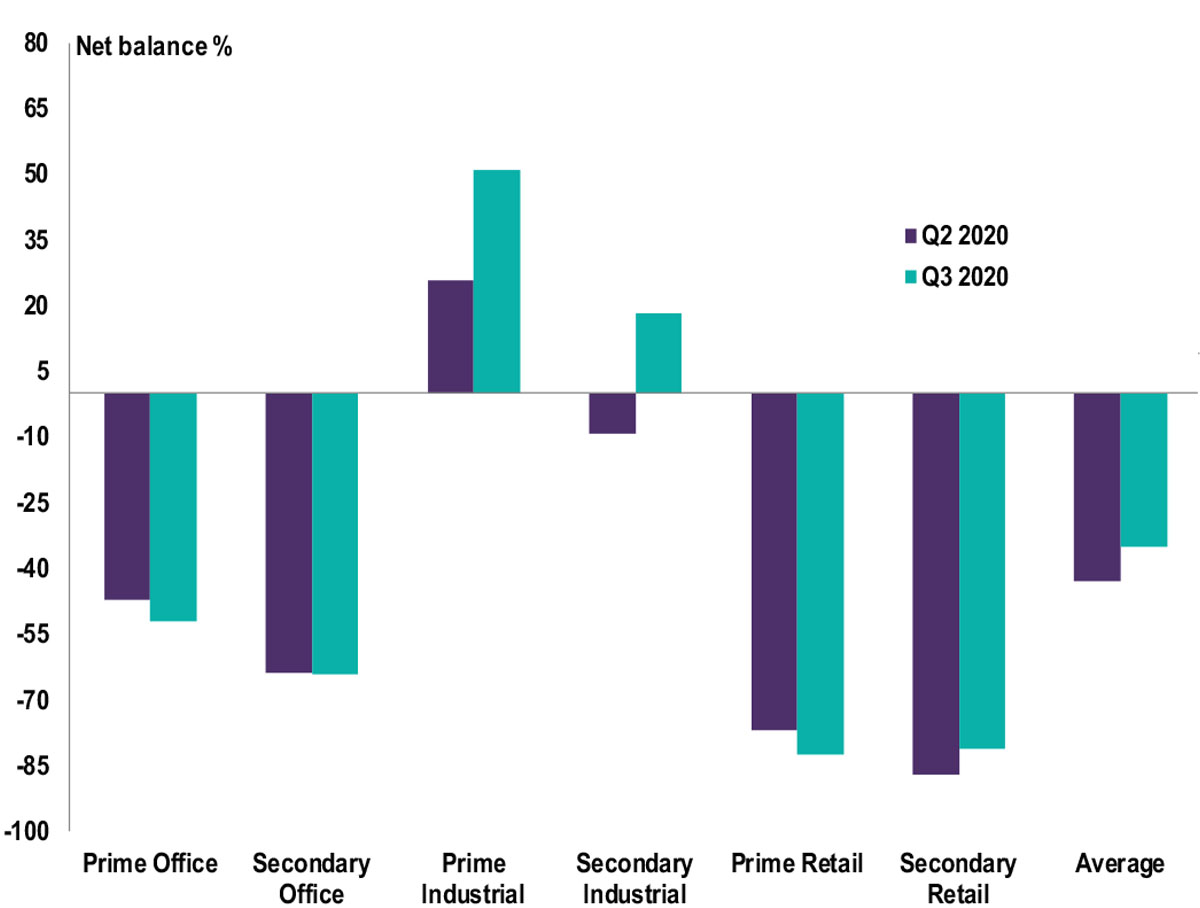

The overarching pattern of negative capital value and rental expectations for retail and offices, alongside positivity for industrials, is mirrored throughout all regions.

Source: RICS, UK Commercial Property Market Survey, Q3 2020

Source: RICS, UK Commercial Property Market Survey, Q3 2020

All details are correct at the time of writing (15 December 2020)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.