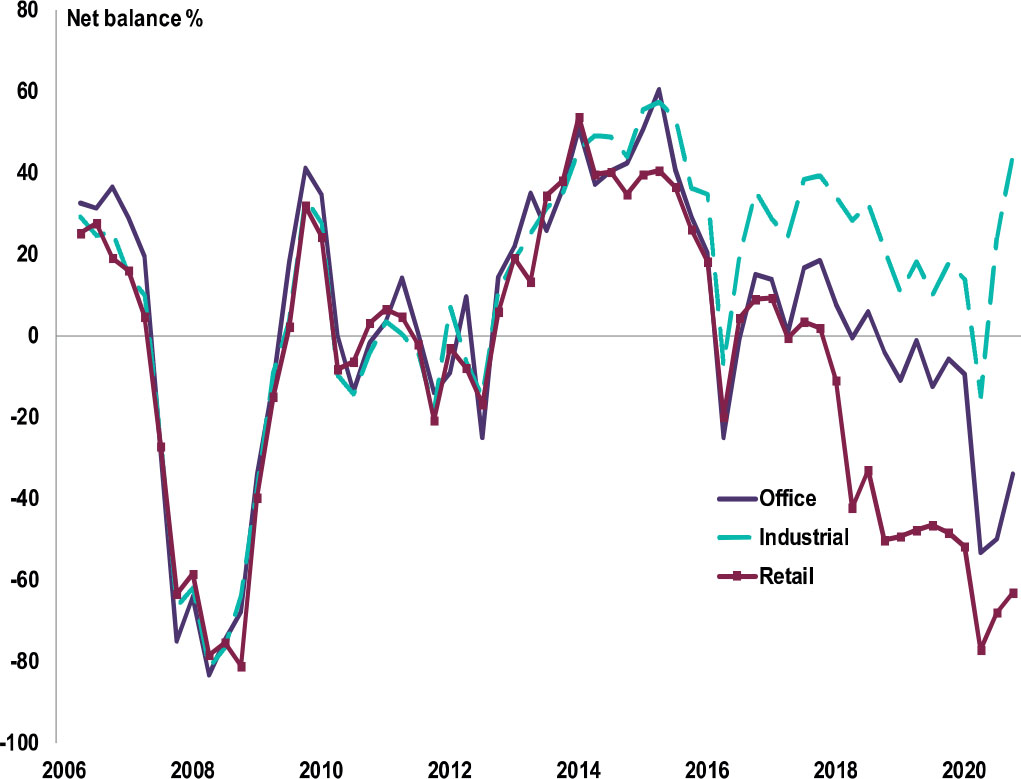

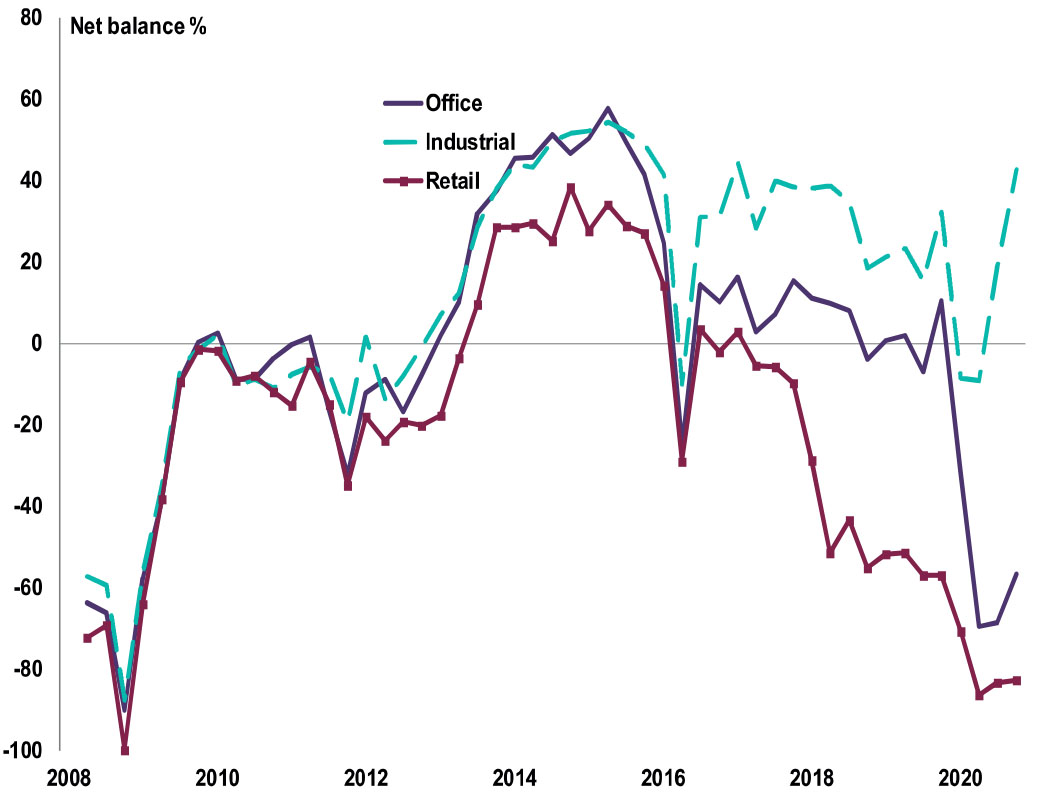

In its latest ‘UK Commercial Property Survey‘, the Royal Institution of Chartered Surveyors clearly emphasise the continuing outperformance of the industrial sector, with both investor and occupier demand strengthening in

the final quarter of last year, in every region of the UK. Interestingly, investment enquiries for UK industrial assets from overseas buyers also increased in Q4.

However, economic pressures caused by the pandemic continue to present challenging conditions, especially in the office and retail sectors, as demand continues to fall. The retail sector posted the sharpest rise in vacant space, while in Q4, availability of leasable office space grew at its strongest rate for over 10 years. At the other end of the scale, industrial availability continued to contract.

The survey outlined, ‘Almost two thirds (63%) of survey respondents consider the market to be in a downturn phase of the property cycle, however Q4 results did show a significant shift in the share of contributors sensing the market may now have reached a floor, rising from just 7% last quarter to 19% this time out.‘

Last year, commercial property investment volumes totalled £1.3bn in Scotland, a decline on the figure registered in 2019 (£2.1bn). The 2020 total is the weakest annual figure in eight years, largely impacted by lockdown measures.

However, despite this drop, some sectors, including distribution warehouses and business parks, where demand was strong, performed well. Over half of all activity by value (54%) originated from cross border capital, while the proportion of institutional investors dropped to a record low of 8%, versus the five-year average of 19%.

According to new analysis from Colliers International, a rebound is expected in 2021. Elliot Cassels, Director for National Capital Markets in Edinburgh, commented, “There is genuine optimism in the Scottish investment market, in anticipation of restrictions being lifted. A Brexit trade deal that looked very unlikely has been struck, which will calm nervous investors – and with mass vaccinations being rolled out across the UK there is finally light at the end of the COVID tunnel.”

With £2.87bn transacted in Q4 alone, this represents the highest fourth quarter investment volumes for London’s West End for six years. According to Savills, this puts Q4 2020 38% above the five-year Q4 average.

Last December’s turnover was the highest monthly volume of 2020, across 12 transactions, totalling £1.16bn. Representing 25% of the total amount transacted in the West End during the entire year. Boosted by the completion of several flagship transactions under offer during Q3, the most notable being British Land’s disposal of a 75% stake in two properties in Seymour Street, and one in Portman Square, comprising 309,000 sq ft of mixed-use accommodation, let to occupants, including seven office tenants.

Head of Central London Investment, Stephen Down, commented, “The scale of uplift seen in Q4, particularly in December, shows the scale of the pent-up demand for London assets and should hopefully be repeated once the current lockdown ends, boding well for the middle and later parts of 2021. We saw European investors accounting for 30% of West End volumes last year, swiftly followed by Asian capital at 28% and UK buyers at 22%. Given the underlying strengths of the market are now coupled with news of a vaccine and certainty of a Brexit trade deal, we anticipate further activity by international buyers throughout 2021.”

Source: Zoopla, data extracted 22 February 2021

| Region | No. properties | AVG. asking price |

|---|---|---|

| London | 1,262 | £1,198,901 |

| South East England | 1,208 | £627,317 |

| East Midlands | 845 | £954,186 |

| East of England | 730 | £530,648 |

| North East England | 869 | £336,335 |

| North West England | 1,573 | £440,903 |

| South West England | 1,655 | £550,775 |

| West Midlands | 1,205 | £506,598 |

| Yorkshire and The Humber | 1,275 | £335,129 |

| Isle of Man | 50 | £477,587 |

| Scotland | 1,276 | £304,458 |

| Wales | 762 | £373,829 |

| Northern Ireland | 27 | £358,750 |

Source: RICS, UK Commercial Property Market Survey, Q4 2020

Source: RICS, UK Commercial Property Market Survey, Q4 2020

All details are correct at the time of writing (22 February 2021)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.